refinance closing costs transfer taxes

Ad Curious How Much You Will Need To Pay In Closing Costs. These are not allowed to change so if you see a.

What Are Closing Costs Jay Villella Real Estate Consultant

Our Home Loan Experts Can Help.

. Compare Top Lenders Now. 5 hours agoHere are the average rates for 30-year 15-year and 10-year refinance loans are. Other closing costs are not.

Transfer taxes are not tax-deductible against your income tax but. Refinance Today Save Money By Lowering Your Rates. If you take that same 100000 value property and add 5000 in refinance closing costs the new cost basis is 95000 beginning in the tax year that you complete the refinance.

Ad Compare the Best Refinance Mortgage Lender that Suits Your Needs with No Closing Costs. Many states charge a feetax when a home is. How to Pay Closing Costs When Refinancing Your Mortgage.

This time last week it was 494. Your Loan Should Too. Compare offers from our partners side by side and find the perfect lender for you.

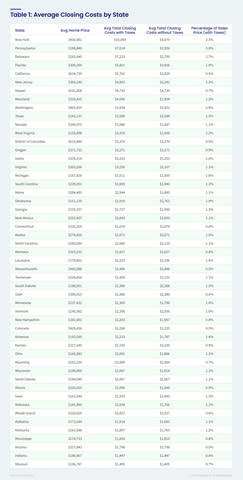

Average refinancing closing costs are 5000 according to Freddie Mac. Today the average 30-year fixed refinance rate is 545. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

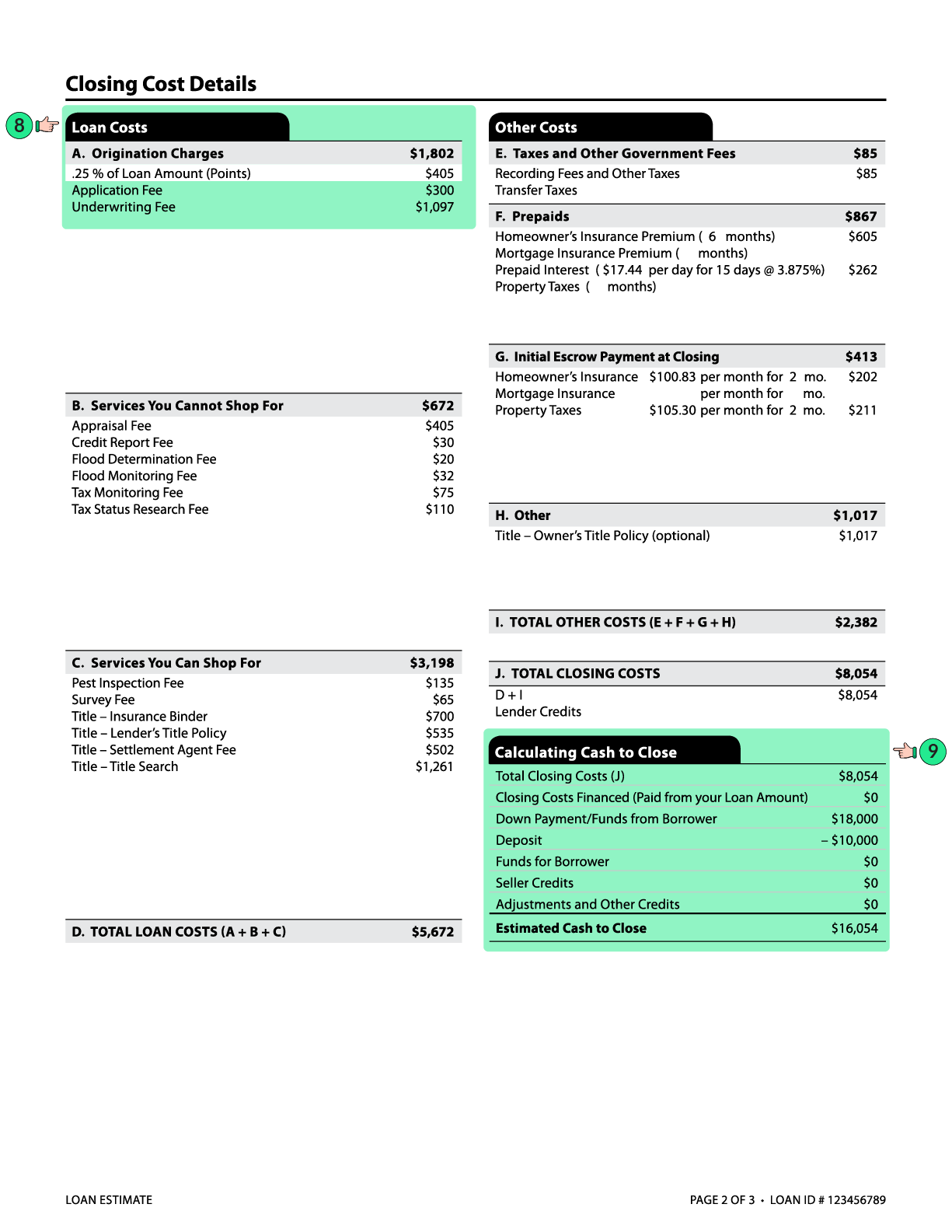

Ad Compare the Best Refinancing Mortgage Rates in Just 2 Min. Tax Implications And Mortgages. Lender fees including origination charges and underwriting fees make up a big chunk of your closing costs.

2400 12 680 034 None. Escrow costs for property taxes and homeowners insurance Your closing costs will vary depending on the new loan amount your credit score and. Ad Best Mortgage Refinancing for 2022.

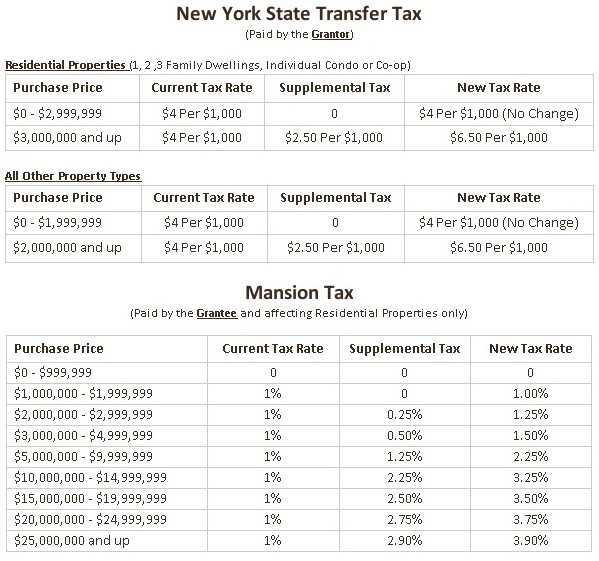

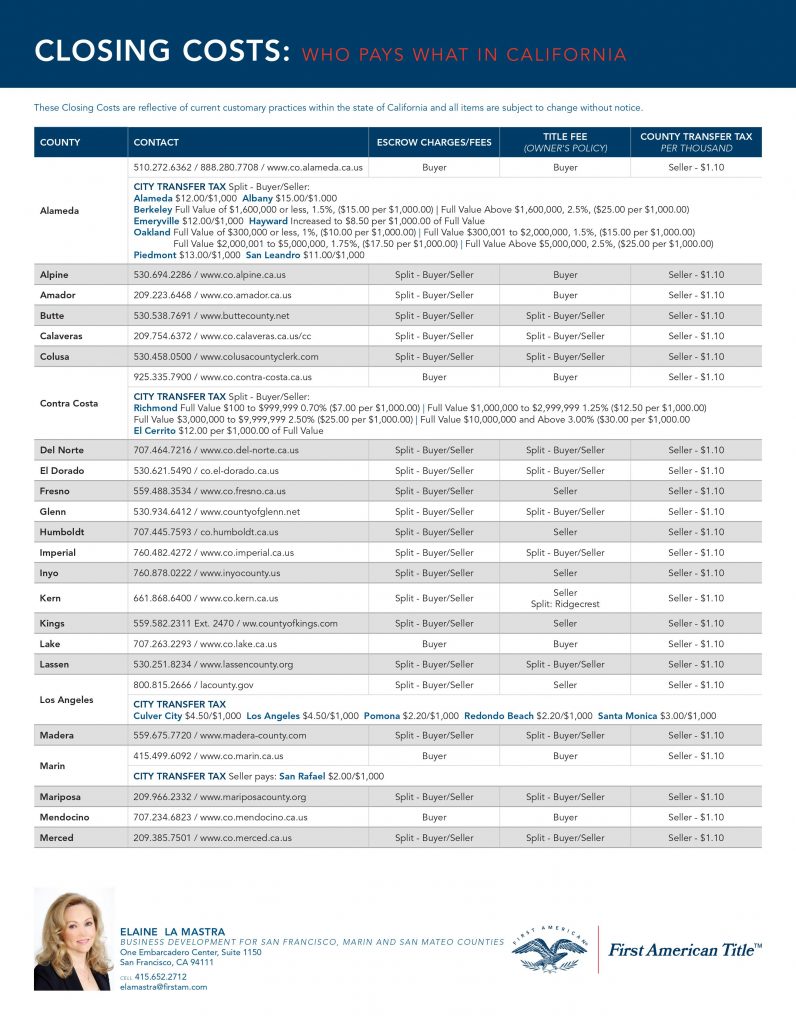

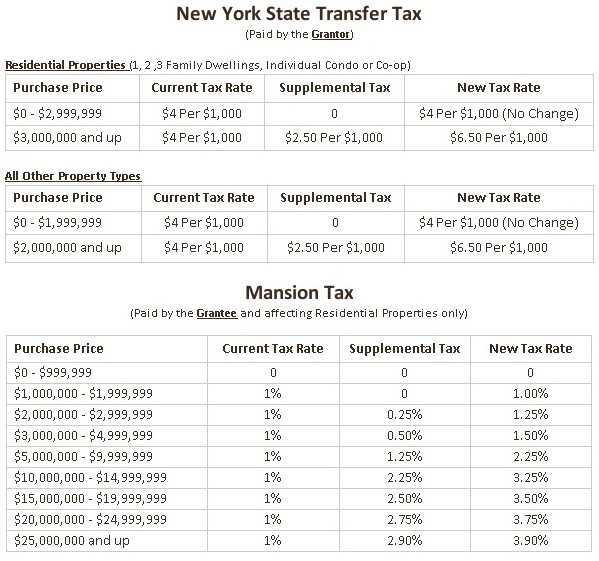

Purchasing A Home In Florida Florida Refinance. Ad Lock Your Rates For Up To 90 Days. State laws usually describe transfer tax as a set.

Apply Online Get Your Rate In 3 Minutes. Ad Best Mortgage Refinancing for 2022. A month ago the average rate on a 30-year fixed refinance was higher at 552.

Minimum FHA Credit Score Requirement Falls 60 Points October 11. Youll typically pay mortgage refinance closing costs equal to between 2 and 6 of your loan amount depending on the loan size. Special Offers Just a Click Away.

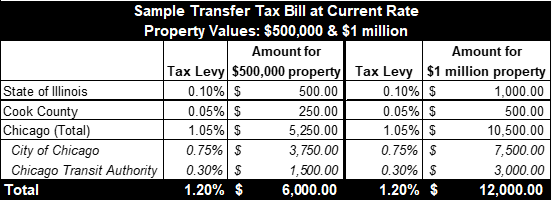

Today the average 15-year fixed. It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

Take Time To Choose The Best Rate Lower Your Payments. No closing costs including the below are not tax deductible but may increase the cost basis of your home which may benefit you in the event of sale. For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your.

Not a single penny. Does not apply to refis just purchased in PA. Compare the Top 5 Best Refinance Companies for 2022.

Top Lenders in One Place. Call us for a quote 2675144630 x1. Homeowner Tax Deductions.

Special Pricing Just a Click Away - Get Started Now See For Yourself. Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Your Guide To 2015 US.

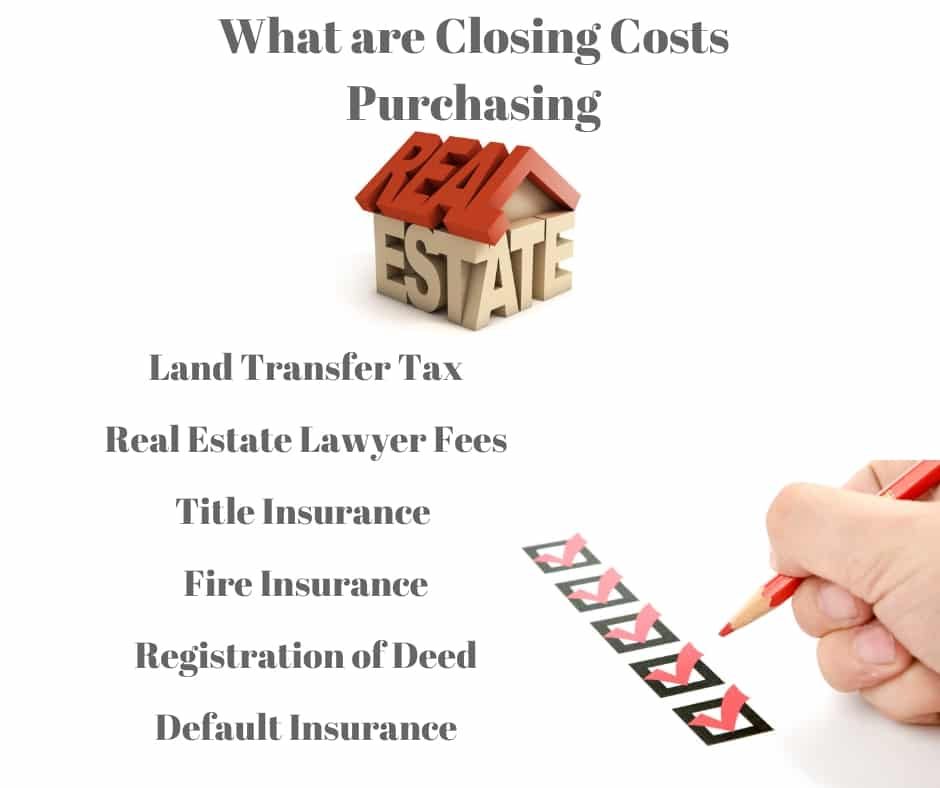

National average closing costs for a single. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. You closing costs are not tax deductible if they are fees.

You accept a loan with a higher principal and take out the difference in cash when you take a cash-out refinance. Compare the Top 5 Best Refinance Companies for 2022. Much like when you first purchase a home there are refinance tax deductions you can claim after refinancing the mortgage loan on your rental property.

A 15-year fixed-rate mortgage refinance of 100000 with todays interest rate of 473. So theres nothing from those costs to add to the cost basis. Top Lenders in One Place.

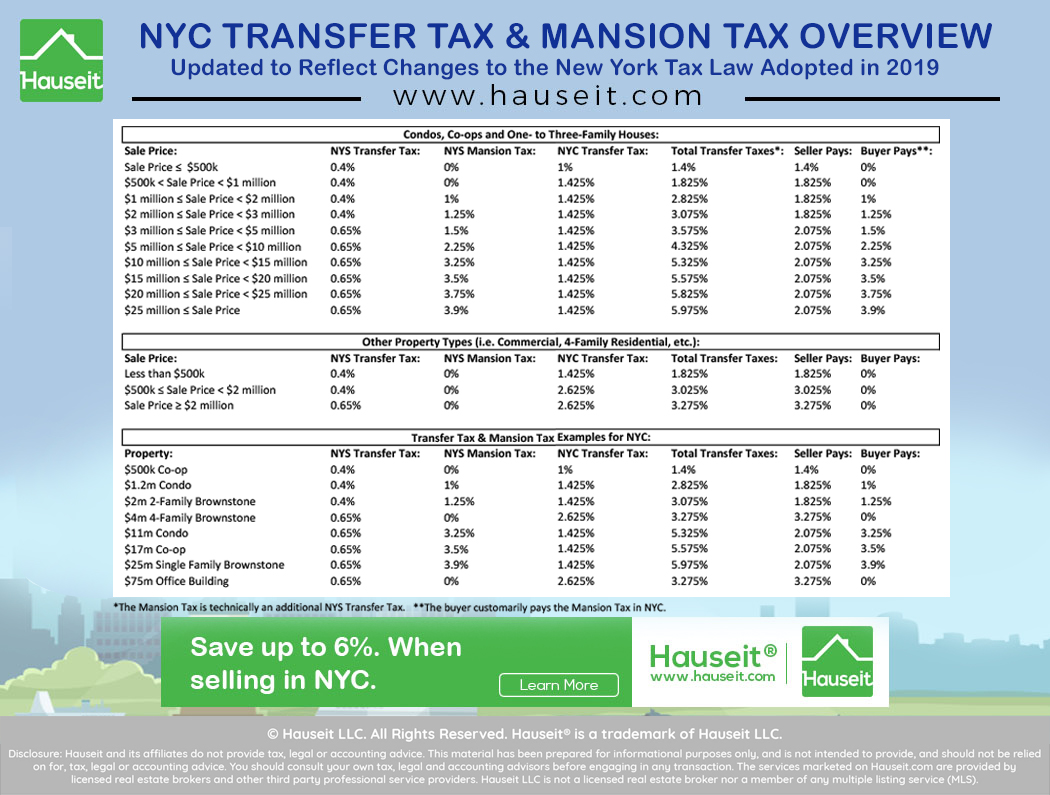

52 rows Total transfer tax. Apply Get Pre Approved. Todays 10 Best Mortgage Refinance Rates Comparison.

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. Compare Top Mortgage Refinance Lenders 2022. Compare Top Lenders Now.

The annual percentage rate on a 15-year fixed is 475. 4 hours agoThe average 30-year fixed-refinance rate is 545 percent down 22 basis points over the last week. Your lender does not know what they are doing.

You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. 70 cents per 100 Documentary Stamps State Tax on the Deed. You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined.

Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Since this is a refinance there are no closing costs associated with acquisition of the property. Get An Affordable Mortgage Loan With Award-Winning Client Service.

Reducing Refinancing Expenses The New York Times

What Are Real Estate Transfer Taxes Forbes Advisor

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs Ontario You Must Know Before Buying Or Selling Property

No Closing Cost Mortgage Is It Actually Worth It Credible

What Is A Real Estate Transfer Tax The Civic Federation

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

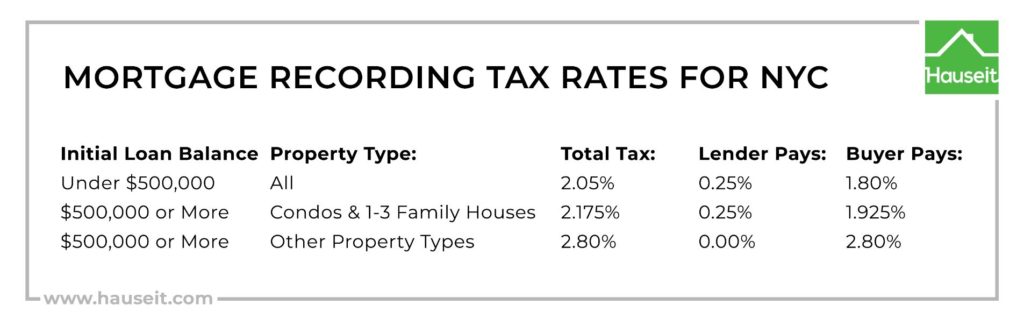

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

The Complete Guide To Closing Costs In Nyc Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

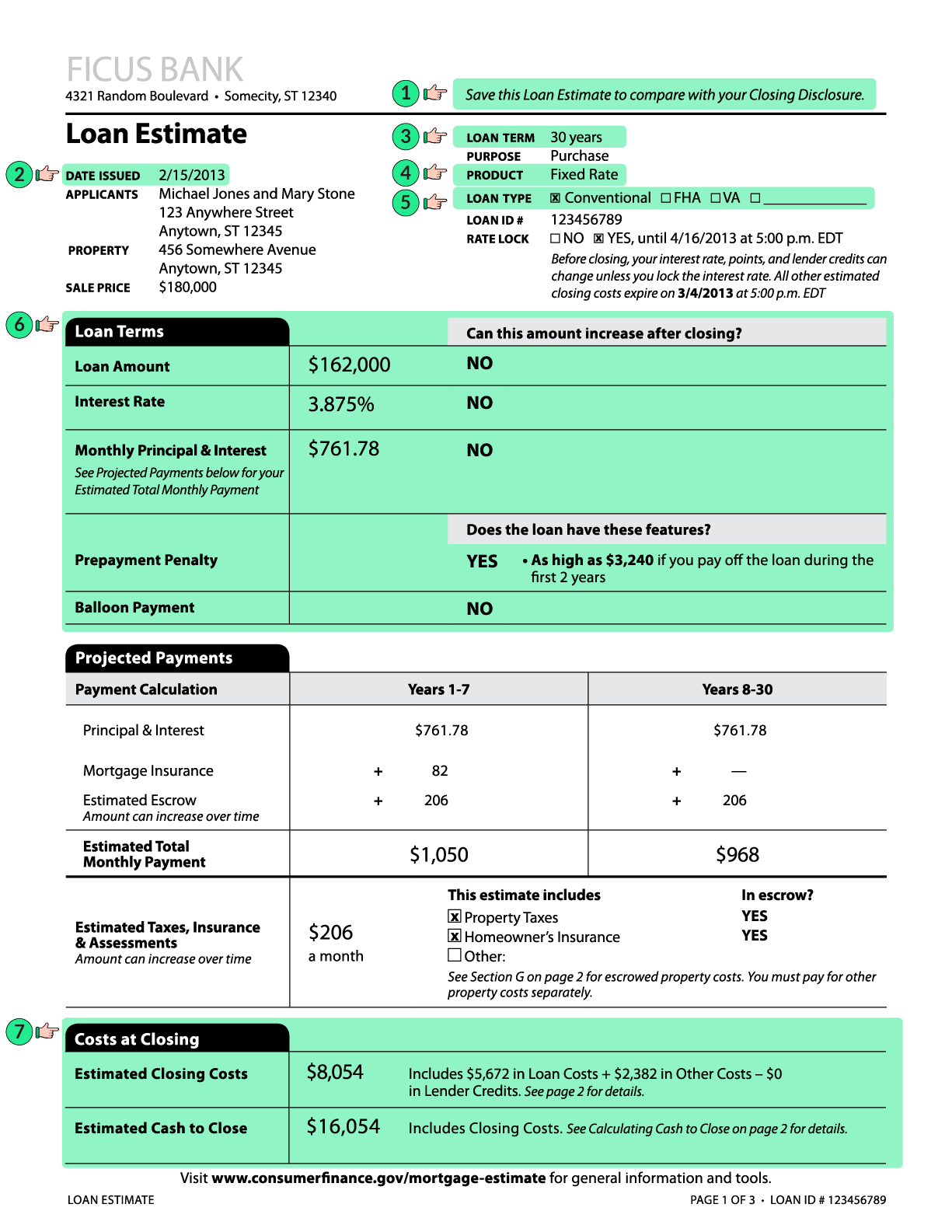

What Is A Loan Estimate How To Read And What To Look For

What Is A Loan Estimate How To Read And What To Look For

Closing Costs Why They Matter And What You Will Pay

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Goes Into Closing Costs Mortgage Loan Credit Refinance Loans Financing Banking Reales Real Estate Infographic Real Estate Tips Real Estate